While world economies are still slouching, India is projected to grow by over 6% in 2024 and 2025. Following its trajectory, the World Economic Forum (WEF) predicts India to become the third-largest economy by 2030. As India grows, so does its middle class and its spending power. Equipped with an extra stash of disposable wealth and the post-pandemic ‘YOLO’ psychological effect, consumers aren’t reluctant to splurge big anymore. In fact, they aspire to indulge in sophisticated, luxury products – making Indians the perfect target consumer for international luxury maisons and Swiss watchmakers.

We’ve intimately analysed Deloitte’s Swiss Watch Industry Insights 2024 Study, which spotlights India and the Indian watch buyer. Highlighting their growing interest in Swiss-made watches, what factors pique their interest, how the Indian consumer has evolved and splurged their lakhs, and the recent Indo-Swiss trade breakthrough, here’s all about it.

A New Indian Generation, A New Definition of ‘Luxury’

For Indians, luxury is synonymous with ‘experiences’ and ‘self-expression’ – emotions embodied by luxury watches. In Deloitte’s 2023 study, 78% of Indian consumers planning on buying a watch in the next 12 months stated their intent of purchasing was simply personal use. On the other hand, as ‘joy’ is a culturally shared sentiment in India, watches have emerged as a frequent choice for gifts during the festive season. The wealth of a new generation has spotlighted a psychological shift – the preference for watchmaking over traditional jewellery, be it for self-indulgence, gifting or investment. “Watches are more frequently wearable and increasingly valued as an investment.” Pratiek Kapoor, Head of Operations & Communication, Kapoor Watch Company. According to Deloitte’s surveys, one in five Indians see luxury watches as a viable investment option against equities – a notable shift prompted by harshly fluctuating markets due to the global pandemic and recent geopolitical instability.

Indian Weddings and Luxury Watches: A Timeless Love Affair

I’ve heard it called ‘The Big Fat Indian Wedding’ for good reason. In a WedMeGood report, 2023 saw Rs 4.74 Lakh Crore in total earnings, a 26% jump from the previous year, proving the region’s obsession with extravagance when tying the knot. Having a grand wedding is perceived as a status symbol, and commodities like luxury watches and jewellery serve as suitable gifts between families of the bride and groom. Interestingly, 42% of Indians are reluctant to strut their luxury watches in crowded spaces compared to the global average of 21%. However, luxury watches’ multi-faceted utility and wearability increase their appeal as a wedding gift.

With extravagance, comes bravado. Deloitte’s survey suggests that 63% of Indians are highly brand-conscious and brand image-conscious when investing in luxury commodities, be it luxury cars, fashion, hospitality, jewellery, and of course, watches. Swiss brands recognise this and are well-positioned to embrace this demand for the matrimonial season.

Does the Younger Consumer Shop Luxury Watches Online?

In order for businesses to survive the pandemic, they needed to bring their offline sales experience and product catalogue online, right to consumer screens. From grocery chains to luxury cars, brands had to digitise their sales and consultancy experience. While the pandemic subsided two years later, this digital experience didn’t, creating a new consumer purchase option and a unilateral sales stream for brands/retailers. According to reports, 70% of Indian consumers purchase watches online through retailers, virtual marketplaces, or brand websites. India’s massive internet user base (second only to China) heavily supported this trend. Additionally, the growth of younger user populations, convenience of purchasing, and product range availability could facilitate this.

Diamonds (And Watches) Are Forever

Jumping right into statistics, over 50% of surveyed consumers in India stated their interest in purchasing a pre-owned luxury watch within the next 12 months, compared to the 38% global average. Furthermore, 49% confirmed their motivation was that pre-owned watches are cheaper than buying a new model, followed by sustainability (41%) and immediate availability (40%). India is expected to follow China’s market expansion trajectory in terms of pre-owned watches. Certification is a must to reaffirm the value of pre-owned watches.

How The Indian Consumer Splurges

Currently, one in four households belongs to the upper middle income (USD 4,000 to USD 8,500 per household) and high-income (USD 40,000 and higher) segment. By 2030, one in two households will fall within this bracket, as stated by the UBS Global Wealth Report (2023). While so, it also indicated that the average wealth per adult in India rose by 8.7% since 2000, reaching USD 16,500 by 2022.

As India grows, so does its middle-class and consumer spending. This economic boom equips this demographic with increasing disposable income and a strong desire to own premium commodities/luxury goods. Half of the surveyed Indian consumers stated they’re willing to splurge on “things that bring them joy”, while 91% of Indian consumers made at least one splurge on a non-discretionary item to ‘treat’ themselves in the last month. Approximately 60% of consumers splurge on luxury goods such as luxury leather goods, eyewear, watches, jewellery, fashion, and cosmetics, with 30% of purchases costing over INR 120,000. This was driven primarily by Gen Z and Millenials in cities like Delhi, Mumbai and Bangalore, and even tier 2 and 3 markets considering the accessibility of the internet.

“The Time to Invest in India Is Now!”

…acclaimed by Dr Ralf Heckner, Ambassador of Switzerland to India, after sixteen long years of negotiations between Switzerland and its European Free Trade Association (EFTA) counterparts, finally signed a trade and economic partnership agreement (TEPA) with India in March 2024. Strengthening the ties between Switzerland and India, this pact opens the floodgates of Swiss exports to India while also abolishing customs duties in many sectors

“The TEPA is more than a classic free-trade agreement. It is a comprehensive and forward-looking partnership that will durably impact the Swiss Indian relations”, commented Jean-Baptiste Délèze, Head of Economic Affairs, Embassy of Switzerland to India and Bhutan. The State Secretariat of Economic Affairs (SECO) estimates that Swiss-origin companies will save up to CHF 166 million (approximately USD 185 million) in customs duties annually. In return, Switzerland and other EFTA states have committed investments of USD 100 billion in India in the next 15 years, generating one million jobs. Alongside benefits to electrical engineering and metal industries, this pact will substantially benefit the watch industry as Swiss exports to India amounted to a staggering CHF 218.8 million in 2023. Custom duties currently stand at around 22-23%, which India has agreed to reduce to zero within seven years. India’s GST of 18% still applies.

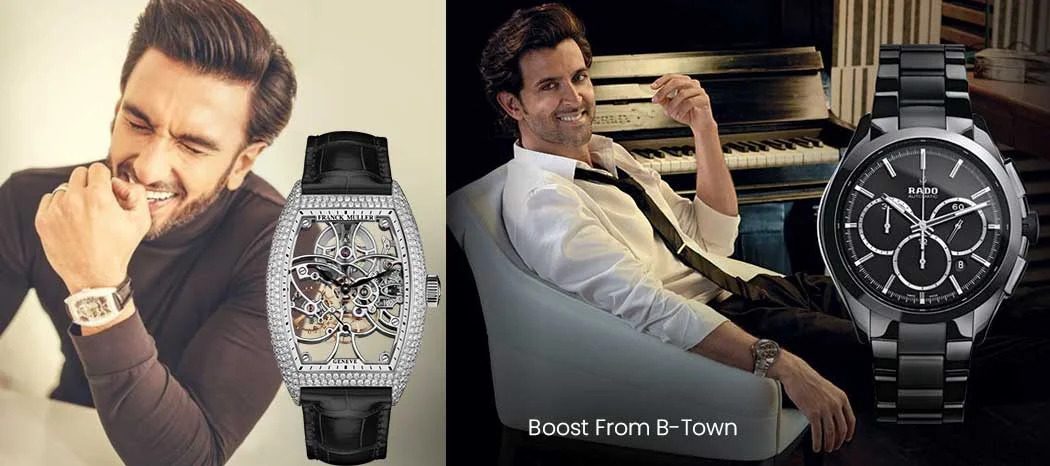

Boost From B-Town

The Indian luxury watch Renaissance has led to a major influx of international maisons into the Indian market, some even customising their offerings to match Indian tastes. In October 2022, Franck Muller unveiled a Devanāgari-indexed, blue Vanguard and Jacob & Co. released an India Edition for their Epic X model the following year. While the roots of various Swiss brands were planted in India almost two decades ago, they’ve consistently sought Bollywood actors and sportsmen as brand ambassadors to further appeal to the market. Take Hrithik Roshan and Katrina Kaif for Rado, Ranveer Singh for Franck Muller, or Priyanka Chopra Jonas for Bvlgari – each strategically chosen, aligning their public reputations and passions with brand legacies.

Recent Posts

Recent Comments

Archives